Have you read dozens of sometimes nearly identical resumes in search of the right candidate for an open role at your insurance organization? Are your eyes beginning to get blurry? Are you dismayed with how few make it into your ‘maybe’ or ‘yes’ piles? With 56 years in the insurance recruiting industry, we have hundreds upon hundreds of resumes under our belts and if there’s one thing we know for sure, it’s that the resume does not tell the whole story.

In 2022, limited candidate pools coupled with high turnover rate in the insurance industry creates a need for both highly meticulous and creative recruiting and hiring strategies. We need to go beyond evaluating a candidate’s resume to better determine if they will make a good long term fit for the company. And that means shifting away from a job experience and technical skill focused mindset.

Instead, we need to learn how to look for and value skills and aptitudes in a candidate’s overall profile. It can often be more difficult to appraise these characteristics of a candidate or weigh them against more measurable attributes. So today we’re going to discuss why recruiting for skills vs experience is so important and how to do it for your next open insurance position.

We’re all familiar with the layout and content of a typical resume–technical skills, past work experience, education, and additional certificates. If you’re an experienced hiring manager, you probably also have a good idea of what you’d like to see in each of these sections. When evaluating resumes you’re likely looking for quantitative evidence of their success in the industry.

You might wonder what their sales quota was, how many accounts they managed, where they received their degree and what they studied, and how many years they’ve worked in the industry. These are, of course, important elements when evaluating resumes but the reality is that you may not see the ideal resume content you’re looking for.

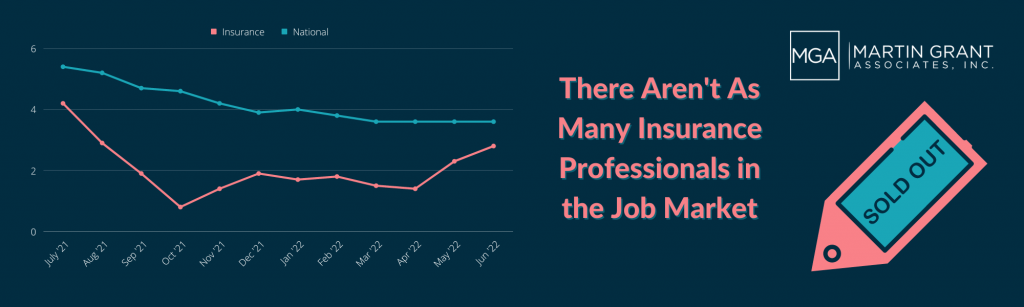

In recent years it’s become increasingly difficult to find professionals with years of experience in the insurance industry who are actively looking for work. The unemployment rate in the insurance industry is 2.8% as of June, 2022 which is a little less than 1% lower than the national unemployment rate.

We’re not saying it’s impossible to find experienced candidates who are willing to move jobs for a great offer but the likelihood that you’ll receive a plethora of applications that check off all your boxes is low. So it’s time to think outside the boxes. Resumes are still relevant and can provide a lot of clues to the quality of the candidate, but evaluating resumes in a way that picks up on skills vs experience requires a different lens.

We’re still not sure if hard vs soft skills are the right terminology when oftentimes both are important and essential characteristics of a great employee. Soft connotes weakness and flexibility, which has nothing to do with attributes that actually fall into this category. But hard vs soft skills are a common set of words used among hiring managers and recruiters to describe the different types of knowledge that a candidate might have.

Hard skills, also referred to as technical skills, are job-specific and relevant to each position and seniority level. Each role in every company will require a unique hard skill set. These are the elements we discussed in the traditional method of evaluating resumes. They are incredibly important, but it’s also critical to note that they aren’t synonymous with an employee’s success in their individual role. It’s often easy to use yes/no criteria to evaluate hard skills.

Soft skills are general characteristics that you’d like to see in all employees, regardless of their position or expertise, or skills that make sense in certain jobs and are less important in others. Some common examples include communication, collaboration and an aptitude for leadership. Soft skills are best assessed by asking situational questions and taking into account the larger picture of a candidate throughout the hiring process.

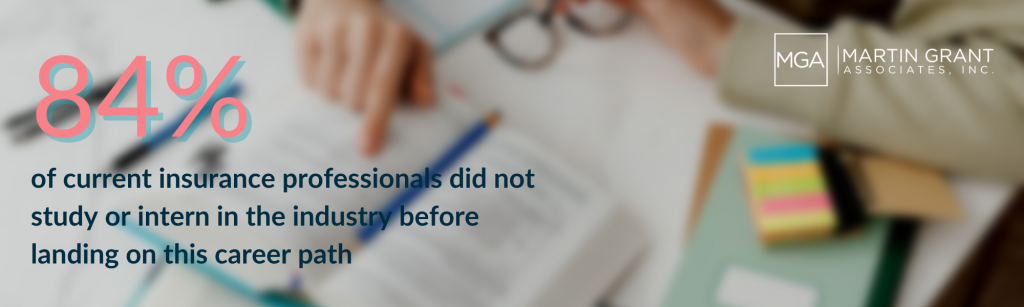

First, let’s take a hard look at the insurance industry. A poll of current insurance employees found that 59% of them “fell into” the industry somewhere along another career path. An additional 25% of insurance professionals were first introduced to the industry through a friend or family member who was already in it. Only 13% of people studied or interned in insurance before pursuing it as their career.

That means that when hiring teams are evaluating resumes and sifting through candidates, there needs to be acknowledgment that some of the best candidates may have little to no experience in insurance. You might want to think about other industries that have the potential for cross-over and begin to look for candidates with experience there.

Even candidates with an ideal set of hard skills can still turn out to be the wrong fit for your opening. They may not work well with the rest of your team, your management style, or be unwilling to learn and grow with the company. You may also find that the hard skills listed on their resume are not always accurate when the candidate is put into a real work setting.

If today’s insurance professionals have proven anything, it’s that the hard skills needed for many insurance positions are highly learnable. It will take hard work, curiosity, and teachability to gain those skills while on the job, but more than 85% of insurance employees have done just that somewhere along their career path. This is why your hiring process needs to include soft skills assessment.

There’s a reason why these skills and characteristics aren’t always part of a streamlined hiring process. Assessing soft skills is trickier than just measuring those years of work or tangible certificates. It takes practice and mindset to properly conduct a soft skills assessment that could not only help you find new candidates but also help make your ultimate hiring decision.

When writing your job description and beginning the recruiting process, think about what characteristics are essential to performing well not only in that role but at your unique organization. Is an independent work style something you’re looking for? Does a warm and level headed demeanor matter for your customer service roles more so than the years of experience a candidate has? These attributes should not be second-thoughts in your process. They should be top of mind when creating an outline for the job and searching for potential employees.

By going through this exercise you will also find that there are ways of evaluating resumes, interviewing, and looking at a candidate’s overall profile that provide clues about their soft skills. For example, a candidate who was attending college and working a full time job simultaneously shows immense drive, perseverance, and work ethic. This person may be a great asset to your team even if they lack some of the hard skills that you were looking for.

By reading between the lines and prioritizing skills vs experience, you see candidates in a wholly new light. There are other methods for assessing soft skills like online personality tests, paying attention to body language in interviews, and asking situational questions during interviews.

Recruiting for skills vs experience is not easy to do. We could go on about the different “tells” there are for soft skills and provide an array of examples where little things like their behavior on LinkedIn or the way they sign their emails tells us worlds about the candidate’s characteristics. We’ve been doing this for more than fifty years and know where and how to look. It’s our job as insurance recruiters to see the whole picture and help our clients find someone who is the right fit for their unique organization. If you need some help evaluating resumes for soft skills or even deciding which attributes are important for your open role, please get in touch with us. We’d love to help you find the person that will grow and succeed at your company!