Millennial and Gen Z recruiting is a hot topic in the hiring market right now, and for good reason. For more than a decade, employers across industries have been asking questions about how these younger generations of employees differ from their predecessors. What are their behaviors, attitudes, and beliefs? And more importantly, how can companies then apply this understanding of the Gen Z and millennial workforce to recruit and retain employees?

The insurance industry is facing an ever-smaller hiring pool and the impending prediction that more than 400,000 insurance employees are expected to retire in the next few years. With that in mind, many insurance organizations are paying closer attention to research around the Gen Z and millennial workforce. There are both opportunities and challenges to attracting these young professionals and often bringing them into a career path they may never have considered before. We’ll first discuss some findings on the behaviors and needs of younger generations in the workplace and then provide 5 ways you as an insurance organization can actively recruit and retain these employees.

In 2019, millennials overtook baby boomers as the largest working generation. Together with Gen Z, they make up more than 40% of current working adults in the US. The US Bureau of Labor Statistics predicts they will represent more than 75% of the workforce by 2030. With this massive representation, it’s no wonder that companies are paying attention to how the younger generations will shape hiring practices and the future of the workplace.

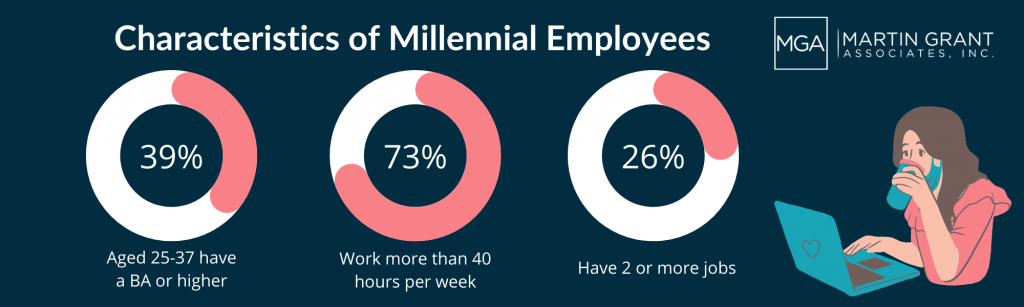

Younger generations are significantly more educated than their predecessors, with 39% of millennials between the ages of 25 and 37 holding a bachelor’s degree or higher. Not to mention women have outpaced men in college completion. This is just one of the ways that younger generations are bringing more diversity into the workplace.

They’ve also been shown to be hard-working individuals. In fact, 73% of millennials work over 40 hours per week and 26% of them have two or more jobs. Statistics show that the stereotype of younger generations being lazy and unmotivated clearly does not hold true.

If insurance organizations and other industry employers alike can manage to attract and retain employees from younger generations, they have the promise of an industrious and intelligent team at their backs. The Gen Z and millennial workforce will clearly dominate the hiring pool for years to come and companies are aiming to make early and long-lasting hires.

But it’s not all rainbows and sunshine.

Despite their hardworking attitude and large role in the workforce, younger generations are known for having lower engagement levels in the workplace and higher turnover than their predecessors. When surveyed about their engagement at their current job, only 29% of millennials claimed they were actively engaged. It’s important to remember that this is only 5% lower than the national average, though it still demonstrates a shift in attitudes towards work.

When it comes to millennials job turnover, more than 21% of employees have switched jobs within 12 months, a number that is three times higher than workers in other age groups. The first step in combating these heightened turnover rates and improving retention of younger employees is understanding why they leave their jobs. We can turn first back to the issue of worker engagement. Although this rests in part on the employees themselves, it’s also important for organizations to consider the ways in which they are creating (or not creating) an engaging work environment. Below, we’ll discuss specific elements of the workplace and company culture that can not only help insurance employers in recruiting but also in improving retention of younger employees.

Eight in ten millennials have limited knowledge of employment opportunities in the insurance industry. There is less understanding of the many avenues within the industry for individuals with different interests such as IT, data analysis, marketing, finance and more. If insurance organizations are going to capture the attention of these younger generations, they will need to do some legwork to raise awareness and evolve their workplaces to meet their needs.

Gen Z and millennials need an avenue into the industry and it’s difficult to be interested in something that they don’t understand. From an outsiders’ perspective, insurance can be full of confusing terminology and intimidating consequences. Research shows that some millennials are putting off buying a car or becoming homeowners, so they may have even less experience with insurance in their personal lives.

Your organization should aim to be a welcoming space where young professionals in search of a new career path can learn about what the industry has to offer them. Consider starting a blog, leveraging social media, or sending representatives to college career fairs. Cover the basics and try to be creative about the different interests that could lead into a role in insurance. Whatever you do, try your best to avoid the vague language often used in job listings.

Time and again, research has shown that younger generations are value-driven people, so it would make sense that they want to use the 40+ hours they spend at work doing something mission-focused. In fact, 75% of millennials believe that businesses are more focused on their own profit than on improving and benefitting society.

When it comes to millennial and Gen Z recruiting, this is where insurance organizations can really get an edge. The core of all insurance work is to help people protect what they love, whether that’s their small business, the health of their pets, or their home. This type of messaging is important not only for clients but for attracting young professionals to the industry. On your website, in your social media and any additional marketing materials, make sure that your company’s mission is front and center.

If your organization makes annual charitable donations or your team participates in volunteering opportunities in your community, don’t be afraid to mention that on your About page, in job descriptions or to interviewees.

On average, millennials want to spend only about 50% of their time in the office. Especially after the remote work pivot that followed Covid-19, flexibility in how employees participate in the workplace is even more sought after. Younger generations also have an interest in creating flexible working hours that suit their lifestyle. Some like to start and end the day early, others want longer breaks in the middle of the day but are willing to work later in the evening.

If your organization is willing to offer partial or fully remote work and equip your employees with the tools they need like laptops, ergonomic desk chairs and even stipends for high-speed internet, you have a leg up on other employers. Just remember that even if an employee is working remotely, they still need the same level (if not higher) of communication and community-building that would often come from being together in an office environment.

Improving retention is a challenge of its own after hiring young professionals. More than a third of millennials say they quit a job because they were offered a better opportunity. If you want to retain employees for the long term, your organization should focus on providing clear paths to growth within the industry. Gallup found that 87% of millennials rank professional development opportunities as one of their top priorities.

Gone are the days of asking, “where do you see yourself in ten years?” Instead, invest in ways to guide your employees through an insurance career path. Host internal training sessions where team members can learn new skill sets from one another and explore different sectors of the insurance landscape. Offer to fund external courses or conference attendance where your team can not only gain expertise but also network and become more connected to the insurance community.

Career development helps to build trust and loyalty between organizations and their employees. It demonstrates that you have your team members’ interest at heart and benefits both parties in the long run.

Both millennials and Gen Z are generations of technology. They grew up with and feel at home on the internet. Young professionals are also accustomed to real-time and continuous communications. They expect and prefer frequent communication and feedback in the workplace to help them stay informed and engaged with the business.

Insurance organizations should prioritize integrating digital tools and software that improve productivity and collaboration. Consider using project management software like Asana or Monday or adding an internal communications app like Slack. As the insurance industry shifts to using mobile apps to provide services like filing claims, scheduling inspections, and submitting videos for appraisal to customers, remember to promote this integration of technology to young job candidates.

Of course, there are a lot of other ways to approach millennial and Gen Z recruiting. In this article, we didn’t discuss recruiting strategies like competitive salaries or cold outreach. We wanted to focus on ways to attract and retain employees that were specific to the unique needs and expectations of young professionals. The big takeaway is to listen to and understand the motives that drive these generations like social mission, long-term thinking, and flexible work-life balance. If you’re feeling lost about how to face the small insurance hiring pool or want to brainstorm with insurance recruiting experts, feel free to reach out and start a conversation! We know you are committed to making your company a great place to work and want to do what we can to help you find the right employees to fill your team.